I am living in US and wanted to transfer some money to India. I want to find out the right time to send money. Since Rupee value is increasing day by day, I want to get more Rupees for my $$. So I started digging into blogs and News related to this topic to find out what’s going in the background.

First reason I found for this Issue is a lot of money is pouring in to India by FII (Foreign Institutional Investors). Pouring means FII’s are buying Rupees for dollars. Demand for Rupee increased so the value.

Inflow by FII’s into India:

list of FII registered at SEBI (

http://www.sebi.gov.in/FIIIndex.jsp)

Rs.6,600 crores ($2.17 billion) in First quarter

This Inward-flow accelerated by Fed Rate cut in US because of sub-prime mortgage debacle (on September 18)

Around Rs.12,000 crores ($3.95 billion) in the month of September

Rs.6,987 crores ($2.3) billion in the first week of October

I read in one article so far (till October 2007), the total FII investment is $14.54 billion (Around Rs.44, 000 crores!!!!) 1

These figures show that there is lot of foreign money in India. Rupee value decreases only if these FII withdraw money from these investments in India.

“There is no reason to conclude that money will flow out... this defies common sense,” the finance minister of India said2.

My amateur analysis came to one conclusion that the following reasons may cause FII’s to withdraw money from these Investments.

1. Interest rate increase by Fed in US

2. Political Instability in India

There is little chance the first could happen since I read news that there is a possibility of further interest rate cut. Even if the interest rate comes to previous stages of sub-prime Investors still prefer emerging Indian Market.

Second could happen because of (NU/UN)clear drama of UPA-LEFT family. Since they are enjoying and postponing the drama like an Indian TV soap opera this may take some time…

so till the end of this year I don’t see any decrease in Rupee value …..

The reason FII’s started pulling out investments in May 2004 is when Left parties asked Govt to stop privatization process, dismantle the divestment ministry and to raise subsidies, which contradicts Investors policies3.

One more interesting thing I found that only 30 companies make up BSE Sensex4

1. Associated Cement Companys Ltd.

2. Bajaj Auto Ltd.

3. Bharat Heavy Electricals Ltd.

4. Bharti Tele Ventures Ltd.

5. Cipla Ltd.

6. Dr Reddy’s Laboratories Ltd. (NYSE: RDY)

7. Grasim Industries Ltd.

8. Gujarat Ambuja Cements Ltd.

9. HDFC

10. HDFC Bank Ltd. (NYSE: HDB)

11. Hero Honda Motors Ltd.

12. Hindalco Industries Ltd.

13. Hindustan Lever Ltd.

14. ICICI Bank Ltd. (NYSE: IBN)

15. Infosys Technologies Ltd. (NASDAQ: INFY)

16. ITC Ltd.

17. Larsen & Toubro

18. Maruti Udyog Ltd.

19. National Thermal Power Corp. Ltd.

20. ONGC Ltd.

21. Ranbaxy Laboratories Ltd.

22. Reliance Energy Ltd.

23. Reliance Industries Ltd.

24. Satyam Computer Services Ltd. (NYSE: SAY)

25. State Bank of India

26. Tata Consultancy Services Limited

27. Tata Motors Ltd. (NYSE: TTM)

28. Tata Power Co. Ltd.

29. Tata Steel Ltd.

30. Wipro Ltd. (NYSE: WIT)

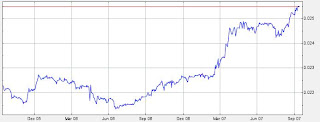

2 Year Chart INR-USD