Location: Cuidad Juarez, Mexico (Near to El Paso, TX)Appointment Date: 28th November 2007

1. Booked Appointment using https://www.usvisa-mexico.com/visa-web/index.jsp? On 28th October 2007

2. Called Victor Garcia (This is the agent who provides transportation and gets Banamex DD for Consulate Fee. He charges 60$ cash only) You can find details http://www.victorgarciainternational.com/

3. Sent him Money Order for ($100 – Mex$1100) along with appointment letter, passport number and contact details (phone and EmailId)Money Order fee is cheaper at USPS – around $1, at Banks it will be around $4

4. Booked one night (to stay on 27th November) at Econo Lodge, 6363 Montana Avenue, EL Paso, TX ($55.39) 915-778-3311. Copy this number in your cell, will be useful to call shuttle once you reach Airport. Or you can find this number in the advertisement area near to the airport exit.

5. Booked one night (for 28th night) at Holiday-Inn Lincoln at Cuidad Jaurez.Phone: 1-800-HOLIDAYPlace: Chihuahua (State), Mexico (Country) , Cuidad Juarez (City)Hotel Code: JUAMXCoupan Code: ILCORVGA for special Bargain: They said they have 2 bed room and costs $120. I said I will think about it and call you later. She asked the reason. I said it is too expensive, I am looking for a room for one night for around $50. She said she could give for $90. Later when I was at hotel I said I am with Victor Garcia and asked for $70. Finally I got it for $79 with taxes (Mex$838.36)

6. Arrived at ElPaso on 27th night and called Econo lodge shuttle, they came and picked me up. Stayed one night. There is a printer at this motel. If you want to make any final corrections to your DS-156/157/158 can do it here. Do your dinner at Airport / take along to have it at motel.

7. Morning 6.45 28th November (Day Of Appointment),, Have breakfast (Donuts) at motel, since you don’t get any breakfast until your visa interview is over. Victor Garcia came around 7.00 in his van which accommodates around 9 people. Gives your Banamex DD, and takes $60 cash.

8. He will take you to Holiday-Inn in Mexico to drop your luggage. Keep all your electronics (including mobile phone) at motel. Then he will drop you at the embassy. There is a computer with internet access and printer at this motel. Get ready with Passport, Appointment Letter. A guard will be at the gate allows you inside after checking you appointment letter and passport. You have to stand in a line

9. There will be 3 counters, one of them will call you when they are done with the person infront of you. they will ask you for DS156/157/158 according to you category and your passport, they will fastly verify data and put NONE in the fields if there is no information. Here you will get token number.

10. After this you have wait in a line to get your picture taken (Wait time – around 20 minutes standing). There will be around 6 counters/pods. There will be display on top of each pod. Look for your token number, upon display of your number go to that pod, Hand over your passport to the officer. Take your coat off, and get ready for your picture taken (No cheeese). After taking picture, she/he will write your name on a green receipt with tomorrow’s date as passport pickup date. Spell check your name. She will tell you to go to the finger printing desk. You have to wait in another line. Wait time around 15 minutes.

11. There is a guy who directs you how to put your fingers on the scanner. After this you should go to another area to wait for the interview

12. All the people who got the tokens will be waiting in the area next to these counters. There will be a electronic display which displays token numbers

13. Most of the time numbers will come in sequence. My counter number was 8002 but it came 1 hour after 8001. So don’t worry if your number is missing.

14. Upon display I went to the counter inside.

15. Questions:Q.who is your employerAns: xyz

Q.Where r you working now?Ans:Client place xyx

Q.Tell me about the project and your roleAns: blah blah..

Q.Tell me about your companyAns:It provides s/w solutions. Blah blah..

Q.The product you are working is it developed by company or customizing?A:Customizing to the client’s needs

Checked for something on computer for 1 minute. I opened my expandable folder, acted like I am ready for any document she will askQns: Asked regarding education.Ans: Master’s in US

Q: Do you have degree certificateAns; No, I don’t have Degree since I completed my master’s recently. Original degree will be awarded in January.

Q:when exactly you have completedA:In September …….and Gave her Grad Walk diploma (and mentioned this is not original degree)…and then gave the letter that I got from International Advisor she has gone through the letter and gave it back

congrats..your VISA got approved….Thank you, you have a nice day

16. came out, there is a taxi stand. Took taxi (5$) to the Holiday Lincoln hotel.

17.Went to lunch MariaChuchena by walk.(5 minutes) (don’t eat Flan de coco. It’s not good). Other dishes ordered by my friends were good. And the restaurant is also good. One Flan De coco+pina culada+deseset (Mex224.40 – USD21.17)

18. Went back to motel, slept for a while. Had dinner at the hotel which is inside Holiday Inn.

19. Woke up around 6, casual dress and went to consulate with luggage bag by WALK . If you have luggage which doesn’t have wheels, I advice you to go by taxi. Even if it has wheels I advice you to go by taxi (5$).

20. There will be lockers to keep your luggage near the entrance gate of consulate. Go to the guard show your green receipt and he will allow you to go little inside to keep your luggage. Keep all electronics including cellphone in the locker. Keep luggage inside the locker and come outside.

21. At exact 8.00 guard will allow you to go inside. Stay in line when called go to the counter, check your name and company name for any typo.

22. Don’t waste time, come out and pick a taxi(5$) to the bridge near border. If you waste time, you may need to wait for more than 1 hour at border protection office. You need to walk 5-8 minutes from the place you get out of the taxi to US customs and border protection office. You will get I-94 here. Go stand in line, pay 6 dollars in cash get your new I-94.

23. Show passport with I-94 to the officer, come out of the building wait near the telephones. Call Victor. He will come and pick you up and take you the airport. Bon Voyage…

Tuesday, April 22, 2008

Arkansas Driving License Study Guide

Arkansas Driving License Study Guide PDF download link is available at the bottom of the page

http://www.asp.state.ar.us/divisions/hp/hp_drivers.html

http://www.asp.state.ar.us/divisions/hp/hp_drivers.html

Saturday, October 27, 2007

To Find out how many H1-B's your employer has filed

Click the following link to find out your employer H1-B filing history. H1-B disclosure data is available till the fiscal year 2006.

http://www.flcdatacenter.com/CaseH1B.aspx

you need to enter following information.

This site is developed and maintained by the State of Utah under contract with the US Department of Labor, Division of Foreign Labor Certification

http://www.flcdatacenter.com/CaseH1B.aspx

you need to enter following information.

This site is developed and maintained by the State of Utah under contract with the US Department of Labor, Division of Foreign Labor Certification

Sunday, October 21, 2007

Saturday, October 13, 2007

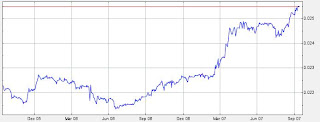

Right time to send money to India - Analysis of Increasing Rupee Value

I am living in US and wanted to transfer some money to India. I want to find out the right time to send money. Since Rupee value is increasing day by day, I want to get more Rupees for my $$. So I started digging into blogs and News related to this topic to find out what’s going in the background.

First reason I found for this Issue is a lot of money is pouring in to India by FII (Foreign Institutional Investors). Pouring means FII’s are buying Rupees for dollars. Demand for Rupee increased so the value.

Inflow by FII’s into India:

list of FII registered at SEBI (http://www.sebi.gov.in/FIIIndex.jsp)

Rs.6,600 crores ($2.17 billion) in First quarter

This Inward-flow accelerated by Fed Rate cut in US because of sub-prime mortgage debacle (on September 18)

Around Rs.12,000 crores ($3.95 billion) in the month of September

Rs.6,987 crores ($2.3) billion in the first week of October

I read in one article so far (till October 2007), the total FII investment is $14.54 billion (Around Rs.44, 000 crores!!!!) 1

These figures show that there is lot of foreign money in India. Rupee value decreases only if these FII withdraw money from these investments in India.

“There is no reason to conclude that money will flow out... this defies common sense,” the finance minister of India said2.

My amateur analysis came to one conclusion that the following reasons may cause FII’s to withdraw money from these Investments.

1. Interest rate increase by Fed in US

2. Political Instability in India

There is little chance the first could happen since I read news that there is a possibility of further interest rate cut. Even if the interest rate comes to previous stages of sub-prime Investors still prefer emerging Indian Market.

Second could happen because of (NU/UN)clear drama of UPA-LEFT family. Since they are enjoying and postponing the drama like an Indian TV soap opera this may take some time…so till the end of this year I don’t see any decrease in Rupee value …..

The reason FII’s started pulling out investments in May 2004 is when Left parties asked Govt to stop privatization process, dismantle the divestment ministry and to raise subsidies, which contradicts Investors policies3.

One more interesting thing I found that only 30 companies make up BSE Sensex4

1. Associated Cement Companys Ltd.

2. Bajaj Auto Ltd.

3. Bharat Heavy Electricals Ltd.

4. Bharti Tele Ventures Ltd.

5. Cipla Ltd.

6. Dr Reddy’s Laboratories Ltd. (NYSE: RDY)

7. Grasim Industries Ltd.

8. Gujarat Ambuja Cements Ltd.

9. HDFC

10. HDFC Bank Ltd. (NYSE: HDB)

11. Hero Honda Motors Ltd.

12. Hindalco Industries Ltd.

13. Hindustan Lever Ltd.

14. ICICI Bank Ltd. (NYSE: IBN)

15. Infosys Technologies Ltd. (NASDAQ: INFY)

16. ITC Ltd.

17. Larsen & Toubro

18. Maruti Udyog Ltd.

19. National Thermal Power Corp. Ltd.

20. ONGC Ltd.

21. Ranbaxy Laboratories Ltd.

22. Reliance Energy Ltd.

23. Reliance Industries Ltd.

24. Satyam Computer Services Ltd. (NYSE: SAY)

25. State Bank of India

26. Tata Consultancy Services Limited

27. Tata Motors Ltd. (NYSE: TTM)

28. Tata Power Co. Ltd.

29. Tata Steel Ltd.

30. Wipro Ltd. (NYSE: WIT)

2 Year Chart INR-USD

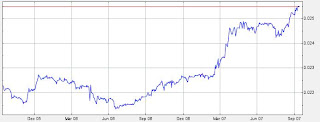

First reason I found for this Issue is a lot of money is pouring in to India by FII (Foreign Institutional Investors). Pouring means FII’s are buying Rupees for dollars. Demand for Rupee increased so the value.

Inflow by FII’s into India:

list of FII registered at SEBI (http://www.sebi.gov.in/FIIIndex.jsp)

Rs.6,600 crores ($2.17 billion) in First quarter

This Inward-flow accelerated by Fed Rate cut in US because of sub-prime mortgage debacle (on September 18)

Around Rs.12,000 crores ($3.95 billion) in the month of September

Rs.6,987 crores ($2.3) billion in the first week of October

I read in one article so far (till October 2007), the total FII investment is $14.54 billion (Around Rs.44, 000 crores!!!!) 1

These figures show that there is lot of foreign money in India. Rupee value decreases only if these FII withdraw money from these investments in India.

“There is no reason to conclude that money will flow out... this defies common sense,” the finance minister of India said2.

My amateur analysis came to one conclusion that the following reasons may cause FII’s to withdraw money from these Investments.

1. Interest rate increase by Fed in US

2. Political Instability in India

There is little chance the first could happen since I read news that there is a possibility of further interest rate cut. Even if the interest rate comes to previous stages of sub-prime Investors still prefer emerging Indian Market.

Second could happen because of (NU/UN)clear drama of UPA-LEFT family. Since they are enjoying and postponing the drama like an Indian TV soap opera this may take some time…so till the end of this year I don’t see any decrease in Rupee value …..

The reason FII’s started pulling out investments in May 2004 is when Left parties asked Govt to stop privatization process, dismantle the divestment ministry and to raise subsidies, which contradicts Investors policies3.

One more interesting thing I found that only 30 companies make up BSE Sensex4

1. Associated Cement Companys Ltd.

2. Bajaj Auto Ltd.

3. Bharat Heavy Electricals Ltd.

4. Bharti Tele Ventures Ltd.

5. Cipla Ltd.

6. Dr Reddy’s Laboratories Ltd. (NYSE: RDY)

7. Grasim Industries Ltd.

8. Gujarat Ambuja Cements Ltd.

9. HDFC

10. HDFC Bank Ltd. (NYSE: HDB)

11. Hero Honda Motors Ltd.

12. Hindalco Industries Ltd.

13. Hindustan Lever Ltd.

14. ICICI Bank Ltd. (NYSE: IBN)

15. Infosys Technologies Ltd. (NASDAQ: INFY)

16. ITC Ltd.

17. Larsen & Toubro

18. Maruti Udyog Ltd.

19. National Thermal Power Corp. Ltd.

20. ONGC Ltd.

21. Ranbaxy Laboratories Ltd.

22. Reliance Energy Ltd.

23. Reliance Industries Ltd.

24. Satyam Computer Services Ltd. (NYSE: SAY)

25. State Bank of India

26. Tata Consultancy Services Limited

27. Tata Motors Ltd. (NYSE: TTM)

28. Tata Power Co. Ltd.

29. Tata Steel Ltd.

30. Wipro Ltd. (NYSE: WIT)

2 Year Chart INR-USD

Sources:

http://www.indianexpress.com/story/225771.html

http://www.indianexpress.com/story/227746.html

http://in.rediff.com/money/2004/may/17fii.htm

http://india.financialnirvana.com/2006/05/23/companies-that-make-up-the-bse-sensex/

http://www.indianexpress.com/story/225771.html

http://www.indianexpress.com/story/227746.html

http://in.rediff.com/money/2004/may/17fii.htm

http://india.financialnirvana.com/2006/05/23/companies-that-make-up-the-bse-sensex/

Sunday, September 23, 2007

Understanding APR and Balance

This is one of the best articles I found on Internet to understand APR.

(Source :- http://www.careonecredit.com/Knowledge/cost-of-credit.aspx )

The Cost of Credit: Understanding APR and Balance Calculations

The cost of credit is not as easy as simply knowing the interest rate. Learn how to evaluate the APR to make good credit decisions.

The Annual Percentage Rate (APR) is the cost of credit (actual interest rate) expressed as a yearly rate. Comparing the APR of loans or credit cards is a quick way to determine which loan or card will likely cost you the most, excluding optional fees such as late payment fees, ATM fees, or obtaining a cash advance. Whether your interest is calculated daily, monthly, or yearly, the APR provides a standardized way of comparing the interest rates on different cards or loans.

The federal Truth in Lending Act requires creditors to disclose the APR on your loan transactions. Why do you need to understand this information? As a consumer of credit, you benefit from understanding the commitments you are making with your money and with your reputation in the credit marketplace. You will also be in a better position to choose the appropriate credit card for your needs. For an example of interest rate and fee disclosure, see the Bank of America terms for one of its credit cards.

Calculating the APR

On credit card billing statements, the finance charge (interest) is expressed in two ways, as a periodic rate (monthly or daily) and as the annual percentage rate. The monthly periodic rate is the annual percentage rate divided by 12.

The example below shows how the APR affects the cost of credit.

To determine the monthly periodic rate on a yearly APR of 18%:

18% ÷ 12 months = 1.5%

To calculate the finance charge using a monthly periodic rate, multiply:

Average Daily Balance x Monthly Periodic Rate = Monthly Finance Charge

(For this example, $100 is the account balance)

$100 x 1.5% = $1.50

Some cards use a daily periodic rate to calculate the finance charge. To get the daily periodic rate, you divide the APR by the number of days in the year (365).

To determine the daily periodic rate on a yearly APR of 18%:

18% ÷ 365 days = .05%

To calculate the finance charge using a daily periodic rate, multiply:

Average Daily Balance x Daily Periodic Rate x Days in the Cycle = Monthly Finance Charge

(For this example, $100 is the account balance)

$100 x .03288% x 31 = $1.02

Balance Computation

Although looking at the APR is the most obvious way to compare credit cards, the method by which credit card issuers determine your balance can make a big difference in how much interest you pay. Here are some of the ways a creditor can calculate the finance charge on your credit card or loan:

Average Daily Balance – The balance is calculated for every day in the billing cycle. Each day, new charges or payments are added to or subtracted from the existing balance. All daily balances are added together and divided by the number of days in the billing cycle to get the average daily balance. The average daily balance is multiplied by the periodic rate to get the finance charge. This is the most common form of balance computation used by credit card issuers.

Two-Cycle Average Daily Balance – The balance used to calculate finance charges is based on two billing cycles. The average daily balance for the current billing cycle and the average daily balance for the previous billing cycle are each calculated as described above. The finance charge would be the sum of both average daily balances multiplied by the monthly periodic rate. Usually this is the most expensive form of balance computation for the credit consumer.

Adjusted Balance – Additional purchases made during the current billing period are not added to the balance for purposes of calculating the finance charge. The payments and credits for the current billing cycle are subtracted from the balance as it was at the opening of the billing cycle, and the finance charge is calculated using this number. Since new purchases are not included (which would raise the balance) and payments are included (which lowers the balance), it usually means a less expensive finance charge. Of all the balance computation methods, it is the least costly to the borrower.

Previous Balance – The previous balance method of computation uses the balance at the opening of the billing cycle. The payments received during the current billing cycle are not subtracted from the balance and additional charges are not added to the balance. The previous balance method results in more costly finance charges than the adjusted balance method because current payments (which would lower the loan balance and thus the finance charge) are not included in the calculation. On the other hand, using the previous balance method results in lower finance charges than either of the average daily balance methods of calculating interest owed.

Shopping for a Low APR

Selecting a credit card with a low APR is good, but you should compare other things as well.

One card may have different APRs for each feature of the card. For example, purchases may be subject to an APR of 14%, while cash advances obtained with the same card may have an APR of 17%.

If your credit card has a variable rate, it can change throughout the year. Read your disclosure statement or talk to your lender to find out additional details about your annual percentage rate.

Look for a card with an APR that suits your situation. If you can pay your balance in full every month, having the lowest APR is not as important as the other fees associated with the card, such as annual fees or cash advance fees. However, if you carry a balance from month to month, then you want the lowest APR possible. But analyze carefully the terms for credit cards with lower APRs. Lenders frequently try to balance the low interest rates with high annual fees and penalties. To compare credit card interest rates and fees, visit the Bankrate.com and the IndexCreditCards.com websites.

Time vs. APR

If you have a credit card with a high APR, you can minimize the effects of this by paying off the debt in a shorter time period. You do this by paying more each month on your credit card balance. This results in a rapidly declining balance that greatly reduces the finance charges. The examples below compare the total finance charges of cards having two different APRs (14% and 18%) with two scenarios (paying the minimum or paying significantly more).

Example 1: There is a 14% APR. The credit card balance is $1,000. We'll assume that no additional charges will be made until the current balance is paid in full. Monthly payments will be received by the due date. If you make a minimum monthly payment of $30, it will take more than 3 years (43 months) to repay the debt, and the total interest paid will be $273.74. But if you choose to make a higher monthly payment of $100, it will take less than a year (11 months) to pay off the balance, and the total interest paid will be $69.50

Example 2: There is an 18% APR. The credit card balance is $1,000. No additional charges will be made until the current balance is paid in full. Monthly payments will be received by the due date. If you make a minimum monthly payment of $30, it will take 4 years (47 months) to repay the debt, and the total interest paid will be $369.74. But if you choose to make a higher monthly payment of $100, it will take 11 months (the same amount of time as it would take to pay off the same debt carrying the 14% APR), and the total interest paid will be $91.57.

These examples show that making a monthly payment greater than the minimum diminishes the impact of the higher APR. In the two examples, paying a higher monthly amount results in paying only $22 more in finance charges if you have the more expensive APR.

Be aware that credit card balances can increase rapidly when only the minimum payments are made and balances are left to accrue interest over time. If possible, only use your credit cards when necessary and pay more than your minimum payment amount each month. Credit grantors are in the business of making money off of your credit card habits, but remember that you can sometimes negotiate with your issuer to obtain a lower APR or lower fees.

It's Not Only APR

In short, the APR is a convenient way to do your first comparison of credit cards, but you must look carefully at other factors, such as the method the creditor uses to calculate the balance used to determine finance charges, and the other fees and penalties associated with the card. Above all, you can save yourself the most money by making the highest monthly payment you can afford to eliminate the debt as quickly as possible.

This article is one in a series about credit cards. For help in selecting a credit card, read the U.S. Federal Reserve article Choosing a Credit Card. For further information on credit, read the related articles in our Knowledge Center Library.

Take control of your finances and debt. Use our calculators and budget planner to help you manage your money.

(Source :- http://www.careonecredit.com/Knowledge/cost-of-credit.aspx )

The Cost of Credit: Understanding APR and Balance Calculations

The cost of credit is not as easy as simply knowing the interest rate. Learn how to evaluate the APR to make good credit decisions.

The Annual Percentage Rate (APR) is the cost of credit (actual interest rate) expressed as a yearly rate. Comparing the APR of loans or credit cards is a quick way to determine which loan or card will likely cost you the most, excluding optional fees such as late payment fees, ATM fees, or obtaining a cash advance. Whether your interest is calculated daily, monthly, or yearly, the APR provides a standardized way of comparing the interest rates on different cards or loans.

The federal Truth in Lending Act requires creditors to disclose the APR on your loan transactions. Why do you need to understand this information? As a consumer of credit, you benefit from understanding the commitments you are making with your money and with your reputation in the credit marketplace. You will also be in a better position to choose the appropriate credit card for your needs. For an example of interest rate and fee disclosure, see the Bank of America terms for one of its credit cards.

Calculating the APR

On credit card billing statements, the finance charge (interest) is expressed in two ways, as a periodic rate (monthly or daily) and as the annual percentage rate. The monthly periodic rate is the annual percentage rate divided by 12.

The example below shows how the APR affects the cost of credit.

To determine the monthly periodic rate on a yearly APR of 18%:

18% ÷ 12 months = 1.5%

To calculate the finance charge using a monthly periodic rate, multiply:

Average Daily Balance x Monthly Periodic Rate = Monthly Finance Charge

(For this example, $100 is the account balance)

$100 x 1.5% = $1.50

Some cards use a daily periodic rate to calculate the finance charge. To get the daily periodic rate, you divide the APR by the number of days in the year (365).

To determine the daily periodic rate on a yearly APR of 18%:

18% ÷ 365 days = .05%

To calculate the finance charge using a daily periodic rate, multiply:

Average Daily Balance x Daily Periodic Rate x Days in the Cycle = Monthly Finance Charge

(For this example, $100 is the account balance)

$100 x .03288% x 31 = $1.02

Balance Computation

Although looking at the APR is the most obvious way to compare credit cards, the method by which credit card issuers determine your balance can make a big difference in how much interest you pay. Here are some of the ways a creditor can calculate the finance charge on your credit card or loan:

Average Daily Balance – The balance is calculated for every day in the billing cycle. Each day, new charges or payments are added to or subtracted from the existing balance. All daily balances are added together and divided by the number of days in the billing cycle to get the average daily balance. The average daily balance is multiplied by the periodic rate to get the finance charge. This is the most common form of balance computation used by credit card issuers.

Two-Cycle Average Daily Balance – The balance used to calculate finance charges is based on two billing cycles. The average daily balance for the current billing cycle and the average daily balance for the previous billing cycle are each calculated as described above. The finance charge would be the sum of both average daily balances multiplied by the monthly periodic rate. Usually this is the most expensive form of balance computation for the credit consumer.

Adjusted Balance – Additional purchases made during the current billing period are not added to the balance for purposes of calculating the finance charge. The payments and credits for the current billing cycle are subtracted from the balance as it was at the opening of the billing cycle, and the finance charge is calculated using this number. Since new purchases are not included (which would raise the balance) and payments are included (which lowers the balance), it usually means a less expensive finance charge. Of all the balance computation methods, it is the least costly to the borrower.

Previous Balance – The previous balance method of computation uses the balance at the opening of the billing cycle. The payments received during the current billing cycle are not subtracted from the balance and additional charges are not added to the balance. The previous balance method results in more costly finance charges than the adjusted balance method because current payments (which would lower the loan balance and thus the finance charge) are not included in the calculation. On the other hand, using the previous balance method results in lower finance charges than either of the average daily balance methods of calculating interest owed.

Shopping for a Low APR

Selecting a credit card with a low APR is good, but you should compare other things as well.

One card may have different APRs for each feature of the card. For example, purchases may be subject to an APR of 14%, while cash advances obtained with the same card may have an APR of 17%.

If your credit card has a variable rate, it can change throughout the year. Read your disclosure statement or talk to your lender to find out additional details about your annual percentage rate.

Look for a card with an APR that suits your situation. If you can pay your balance in full every month, having the lowest APR is not as important as the other fees associated with the card, such as annual fees or cash advance fees. However, if you carry a balance from month to month, then you want the lowest APR possible. But analyze carefully the terms for credit cards with lower APRs. Lenders frequently try to balance the low interest rates with high annual fees and penalties. To compare credit card interest rates and fees, visit the Bankrate.com and the IndexCreditCards.com websites.

Time vs. APR

If you have a credit card with a high APR, you can minimize the effects of this by paying off the debt in a shorter time period. You do this by paying more each month on your credit card balance. This results in a rapidly declining balance that greatly reduces the finance charges. The examples below compare the total finance charges of cards having two different APRs (14% and 18%) with two scenarios (paying the minimum or paying significantly more).

Example 1: There is a 14% APR. The credit card balance is $1,000. We'll assume that no additional charges will be made until the current balance is paid in full. Monthly payments will be received by the due date. If you make a minimum monthly payment of $30, it will take more than 3 years (43 months) to repay the debt, and the total interest paid will be $273.74. But if you choose to make a higher monthly payment of $100, it will take less than a year (11 months) to pay off the balance, and the total interest paid will be $69.50

Example 2: There is an 18% APR. The credit card balance is $1,000. No additional charges will be made until the current balance is paid in full. Monthly payments will be received by the due date. If you make a minimum monthly payment of $30, it will take 4 years (47 months) to repay the debt, and the total interest paid will be $369.74. But if you choose to make a higher monthly payment of $100, it will take 11 months (the same amount of time as it would take to pay off the same debt carrying the 14% APR), and the total interest paid will be $91.57.

These examples show that making a monthly payment greater than the minimum diminishes the impact of the higher APR. In the two examples, paying a higher monthly amount results in paying only $22 more in finance charges if you have the more expensive APR.

Be aware that credit card balances can increase rapidly when only the minimum payments are made and balances are left to accrue interest over time. If possible, only use your credit cards when necessary and pay more than your minimum payment amount each month. Credit grantors are in the business of making money off of your credit card habits, but remember that you can sometimes negotiate with your issuer to obtain a lower APR or lower fees.

It's Not Only APR

In short, the APR is a convenient way to do your first comparison of credit cards, but you must look carefully at other factors, such as the method the creditor uses to calculate the balance used to determine finance charges, and the other fees and penalties associated with the card. Above all, you can save yourself the most money by making the highest monthly payment you can afford to eliminate the debt as quickly as possible.

This article is one in a series about credit cards. For help in selecting a credit card, read the U.S. Federal Reserve article Choosing a Credit Card. For further information on credit, read the related articles in our Knowledge Center Library.

Take control of your finances and debt. Use our calculators and budget planner to help you manage your money.

Saturday, September 15, 2007

Subscribe to:

Comments (Atom)